When you buy a life insurance policy, you sign an agreement and pay a premium—either monthly or annually—to the insurance company on a regular basis for a predetermined amount of time.

The insurer will provide your dependents or loved ones with access to the assured sum in the event of your death. If you survive, you might be eligible for a maturity payment based on the terms and conditions.

It provides your family with financial security by acting as a cushion.

What to anticipate when buying a life insurance policy is as follows:

- Choosing a policy: You must first decide on the kind of life insurance policy you want, the amount of coverage you need, a term that best suits your needs, and the beneficiaries.

- Application: After that, you complete the required steps and fill out the application form. A medical examination might also be necessary to evaluate your health.

- Approval and payment: After that, you get the policy documentation and start making regular premium payments.

- Regular premium payment: Throughout the policy's term your main concern is making premium payments to maintain the status of your policy. Additionally, you are free to modify as needed.

- Maturity/Death: When the policy matures or the insured passes away, the insurer will pay the designated beneficiaries the death benefit or maturity amount.

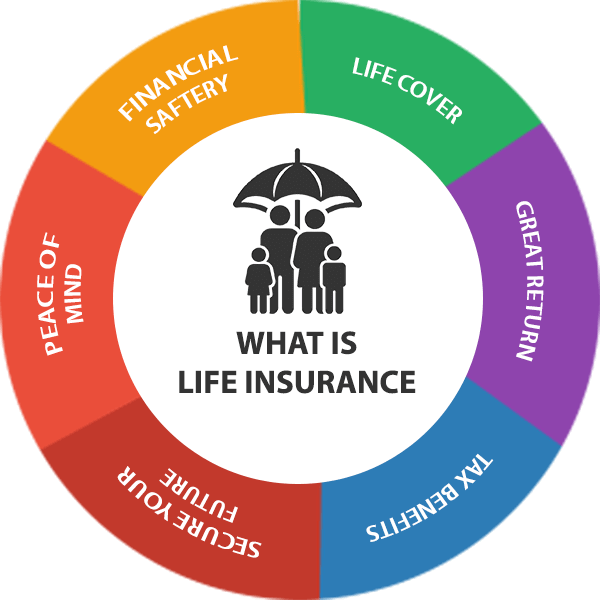

Once you buy life insurance, here are the benefits which it will offer in your financial life:

- It lowers your tax burden

You should buy insurance if for no other reason than that you can deduct your premiums from your taxes.

- It will assist your family with debt repayment.

We never know what the future holds for us in life. Your family might have to deal with a car loan, credit card debt, or other loans if something were to happen to you. A life insurance policy's payout can assist your loved ones in paying off these debts.

Healthy individual.

- It can provide you assistance in achieving long-term goals.

You can invest modest sums that will add up over time to help you buy the house of your dreams or launch the business of your dreams, depending on the insurance plan you select.

- It offers a safety net for finances.

Being the breadwinner in the family, your loss will have a financial as well as emotional impact. Your family and loved ones will have a financial safety net to support them during their grieving process if you have good life insurance.

:max_bytes(150000):strip_icc()/GettyImages-1365436662-e970848785b44c14bf1510e6fb0ec206.jpg)

English (US) ·

English (US) ·