Have you ever wondered what would happen to your family in case of your untimely demise someday? Who will take care of their finances, such as their EMIs, grocery, education and marriage expenses? Will your investments or savings be enough to help them survive for long? If you are indeed worried about all this, then life insurance is surely the answer.

In exchange for your premium payments over the course of the policy term, the life insurrer such as HDFC Life offers you a life cover sum. Life insurance cover safeguards the future of your family by providing a lump sum payment, also known as a death benefit, in the event of your untimely demise during the policy’s term. Moreover, upon the expiration of the policy term, certain life insurance policies offer you a maturity benefit.

As you pay the life insurance premiums, the insurer agrees to pay a certain amount of money to the beneficiary of the life insurance policy upon the policyholder's death or after a predetermined period of time, which is the cover amount.

Because paying premiums is the only way to access all the benefits of a life insurance policy, it is best to choose a premium that is affordable. Only when you keep paying all premiums on time, the insurer offers the cover amount promised.

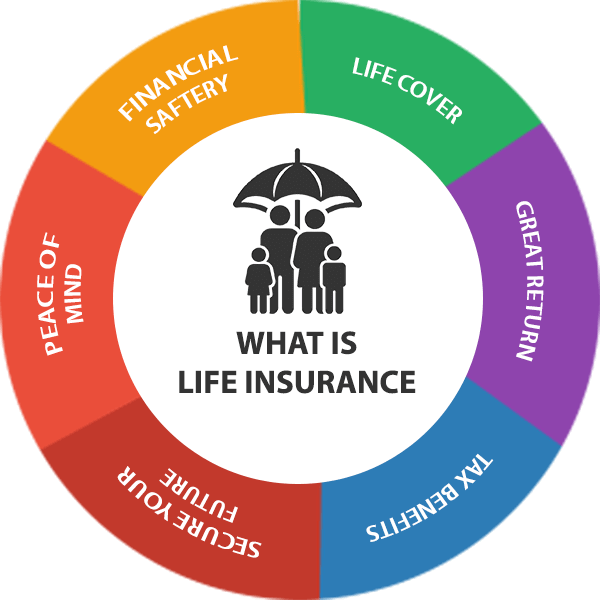

Now comes the question, why buy a life insurance? What benefits does it offer? Well, let us simplify that for you.

The most vital benefit of life insurance is safeguarding your finances. Any type life insurance plan has the ability to give your family financial stability is one of its main advantages. A death benefit is a core part and is included in life insurance policies. Your family members or nominee(s) will receive the sum assured, which is a predetermined amount if you pass away within the policy's term. This guarantees your family members' financial stability even when you aren't around.

The second benefit of life insurance is that it helps inculcate a savings habit. In order to maintain the validity of your life insurance policy, you must make periodic payments or premiums. Your policy may be cancelled if premiums are not paid. Thus, you develop a saving habit that will serve you well in the long run by investing on a regular basis.

Life insurance also promotes tax savings. The government has extended tax savings to a wide range of investment instruments in an effort to encourage savings and investment. One such tool is life insurance. As per deductions under 80C of the Income Tax Act of 1961*, you are eligible to receive a tax deduction of up to Rs 1.5 lakh for the annual premium that you pay. You thus get the advantage of both tax savings and investment.

Another benefit is that life insurance helps reach your major financial goals in life. Over time, some life insurance policies accrue cash value. Policies for life insurance, like ULIPs, also include an investment component. Your premium is invested and yields a return on marketable securities. They accumulate over time into a sizable corpus that can be utilised to accomplish objectives like your child's education, child marriage, etc.

The fifth benefit of life insurance is distribution & wealth protection.One of the safest long-term investment options are life insurance policies. Hence, having life insurance will enable you to protect your wealth from taxes & inflation for an extended period of time. Because of this feature, life insurance plans are excellent tools for retired investors to create long-term pensions.

:max_bytes(150000):strip_icc()/GettyImages-1365436662-e970848785b44c14bf1510e6fb0ec206.jpg)

English (US) ·

English (US) ·