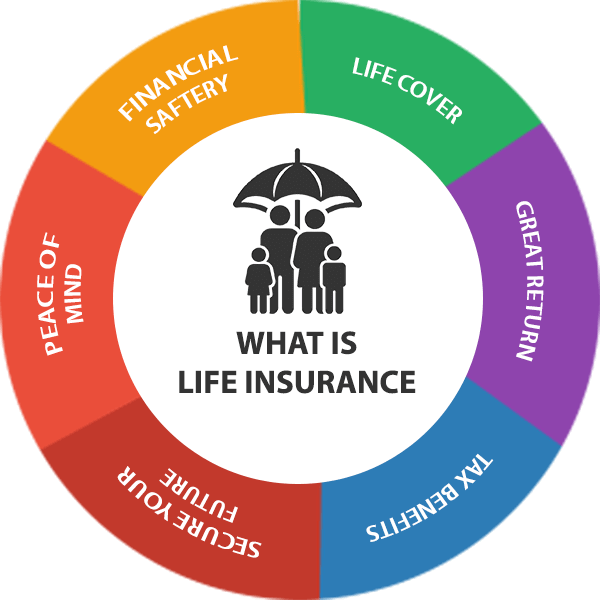

Buying a life insurance is important in more ways than one. Let us explain why purchasing life insurance is not an option but a necessity:

1

Financial security for your family & loved ones

A life insurance plan can help your family live comfortably and worry-free by replacing your income in the event of your death. It assists them in maintaining their way of life and paying for bills like food, rent, schooling, etc.

2

To pay for your children's future education

If the family's primary provider dies, the cost of their education may become extremely burdensome. Even if you are not living, life insurance makes sure your kids attend the college of their choice.

3

To save for retirement and make plans for future

Unexpected occurrences such as illness and disability can cause financial ruin for your family. It functions as a safety net and pays for expenses in unanticipated situations.

4

To settle any debts you may owe

Your family may have financial hardships following your death as a result of your debts. Life insurance provides financial freedom to your family members by assisting them in paying off debts such as credit card bills and house loans.

5

To qualify for tax deductions** under the Income Tax Act

Under section 80C of the Income Tax Act, you can benefit from tax deductions of up to Rs 1.5 lakhs annually with the premiums you pay. You can also avail section 80d the premiums you pay for add-on riders.

6

For financial security and peace of mind

Life insurance can provide you with a sense of calm by ensuring that your family is secure financially and does not need to worry about your debts. You can then live a confident and stress-free life.

:max_bytes(150000):strip_icc()/GettyImages-1365436662-e970848785b44c14bf1510e6fb0ec206.jpg)

English (US) ·

English (US) ·